Membership

NG Clearing offers three types of clearing membership:

General Clearing Member (GCM):

A clearing member that clears transactions or contracts on its own behalf and/or in respect of its clients. The GCM is required to perform all obligations (margins, settlement obligations etc.) registered in its account and those of its clients, irrespective of whether the client has complied with its obligations.

Self-Clearing Member (SCM):

A clearing member that is permitted to clear transactions or contracts on its own behalf. SCMs are responsible for the fulfillment of all the obligations (margins, settlement obligations etc.) arising out of trades executed and cleared by them.

Professional Clearing Member (PCM)

A clearing member that is permitted to clear transactions or contracts only in respect of clients. PCMs are responsible for the fulfillment of their client’s obligations (margins, settlement obligations etc.).

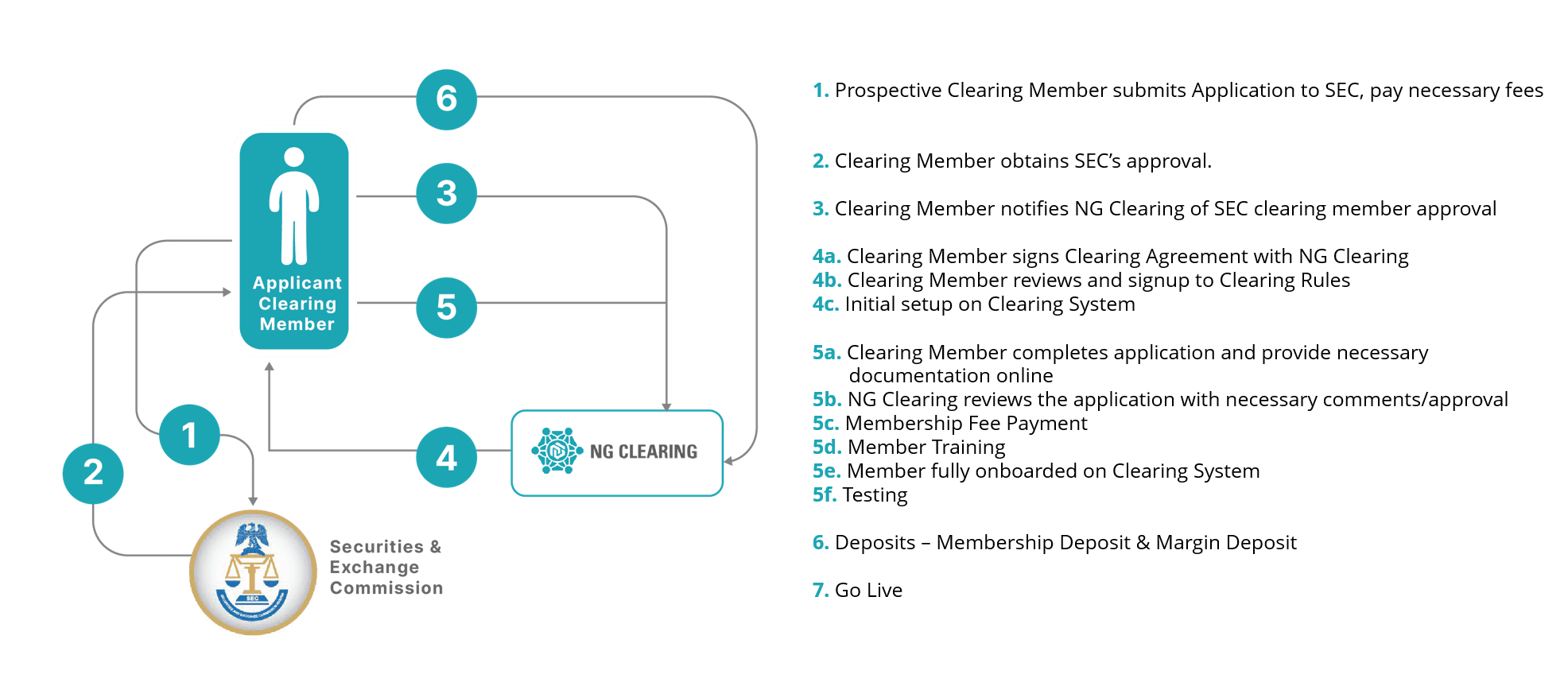

To be eligible for membership, prospective Clearing Members must satisfy certain admission criteria stipulated by the Company. The admission criteria are stated in the Company’s Rulebook and comprise financial and non-financial requirements. The financial requirements include the payment of a non-refundable application fee and other financial obligations such as annual fee and membership deposit. The non-financial requirements include technical, operational, legal/regulatory, governance and other requirements. The eligibility process is divided into four (4)

- Payment of a non-refundable Application Annual Membership: The fee is charged on a pro-rata basis (calculated from the admission date to the end of the financial year) and payable before the admission date.

- Any other fees that NG Clearing may stipulate at the time of admission and approved by SEC.

- Undertaking to:

- Pay all applicable transaction and other fees;

- provide intraday initial margin, variation margin and additional margin to NG Clearing (where applicable);

- maintain adequate variation margin levels at NG Clearing; and

- contribute to the default fund as may be required from time to time

- Valid Legal Identifier issued by an accredited issuing organization that is duly authorized by the Global Legal Entity Identifier Foundation

- A copy of the applicant’s business continuity and disaster recovery framework.

- Evidence that the applicant is rated by a reputable rating agency and satisfies NG Clearing minimum credit rating.

- The applicant shall satisfy NG Clearing as to its fitness and propriety, financial, operational, technical and risk management capacity, competence, facilities, and organizational arrangements to be able to satisfy its obligations under the NG Clearing’s Rules and other applicable rules and law.

- The applicant shall satisfy NG Clearing that it has adequate recording, reporting of clearing and settlement procedures and information (where applicable) and, if relevant.

- The applicant shall satisfy NG Clearing that it has adequate personnel, physical facilities, books and records, accounting systems and internal procedures to enable it satisfactorily to handle transactions and communicate with NG Clearing, fulfil anticipated commitments to and satisfy the operational requirements of NG Clearing with necessary promptness and accuracy, and conform to any condition and requirement that NG Clearing reasonably deems necessary for its protection or that of its Members.

- The applicant must maintain a back office:

- which is remote from both the trading floor and/or trading desks (where applicable); with adequate systems (including but not limited to computers and communications systems) and records.

- with an adequate number of administrative staff fully conversant with procedures for the management of business transacted in the markets and contracts cleared by NG Clearing and in which the applicant will participate; and

- with such equipment (including technology and connectivity) as may be stipulated by NG Clearing.

- The applicant shall appoint representatives to represent it. The representatives must be persons sufficiently senior and who have relevant knowledge as determined by and acceptable to NG Clearing. The representatives must understand:

- the nature of the contracts sought to be cleared by the applicant;

- risks and obligations of trading in the markets;

- and the provisions of applicable law.

- The applicant and/or its representatives must not have been convicted for:

- an offence involving dishonesty, impropriety, fraud, theft, false accounting, robbery, embezzlement, extortion, fraudulent conversion, fraudulent concealment, forgery or misappropriation of funds, securities or other property

- offences against the administration of public justice or any criminal offence involving breach of a fiduciary obligation, or arising out of the conduct of the business of a financial institution;

- tax offences; or an offence relating to companies, insurance, banking, other financial services, consumer credit or consumer protection, money laundering, bribery, market abuse or insider dealing; or

- any criminal offence involving the purchase, sale or delivery of any security; the taking of a false oath; the making of a fraudulent statement; the making of a false report; bribery; perjury; or conspiracy to commit any offence referred above. Furthermore, the applicant must not be, or have any representative who is, under investigation for committing any of the above-mentioned

- The applicant and/or its representatives (as applicable) must not have been:

- dismissed from a previous employment for dishonesty or impropriety and the company must not have in its employment, a person who has been so convicted or dismissed. The Board of NG Clearing shall have the sole discretion to determine acts or omissions that constitute dishonesty or impropriety;

- expelled or suspended from or had its participation terminated by any regulatory body or exchange or by NG Clearing or other similar entity that engages in clearance and settlement activities or a securities depository, or has been barred or suspended from being associated with any member of such an exchange, body, NG Clearing, or securities depository;

- permanently or temporarily enjoined or prohibited by order, judgment or decree of any court or other governmental authority of competent jurisdiction or by any regulatory body from acting as, or as a person associated with or as an affiliated person or employee of, a financial institution, or from engaging or in continuing any conduct or practice in connection with any such activity, or in connection with the purchase, sale or delivery of any security, and the enforcement of such injunction or prohibition has not been stayed.

- Representatives must not have been found complicit in the operation of an institution that has failed or been declared bankrupt or has had its operating license revoked as a result of mismanagement or corporate governance abuses.

- Representatives and members of staff that deal with the applicant’s clearing services possess the ability to make sensible and informed business decisions and recommendations.

- The applicant shall satisfy NG Clearing that it has in place adequate written anti-money laundering, bribery, and corruption, and complies with the Nigeria Data Protection Regulation 2019 and any other relevant data protection law or regulation. The applicant shall also satisfy NG Clearing as to its identity for the purposes of applicable money laundering regulations, and as to the steps it will take for such purposes to verify the identity of persons for whom it clears transactions.

- The application process for applicants may include a due diligence visit to the applicant’s offices.

- Applicants shall, at NG Clearing’s request, provide NG Clearing with copies of any reports or notifications to a regulator by the applicant in relation to the applicant's financial status, exposure to risk and compliance with any regulatory capital requirement or other financial requirement imposed on the applicant by the regulator where such reports or notifications or the information contained therein would be materially relevant to NG Clearing's assessment of the applicant's financial condition, credit worthiness, or fitness to become or remain a clearing member.

- The applicant shall satisfy NG Clearing that its shareholders and directors are fit and proper persons (legal or artificial).

- Submission of the duly completed application form via our online platform https://ngclearing.com/membership with the required application fee. The applicant shall in the form, specify:

- the category of membership it is seeking to obtain (see paragraph above – Category of Membership);

- and the types of business and products/asset class it seeks to clear (see Appendix 1 below – Segments).

- Execution and submission of 2 (two) undated originals of the Membership Agreement between the applicant and NG Clearing. An original of a signed consent letter (in the form prescribed by NG Clearing) to credit/debit the applicant’s account through the settlement system of the Nigeria Inter- Bank Settlement System PLC

- Where applicable, execution and submission of 2 (two) originals of the undated security document creating a security interest or other collateral arrangement in favour of NG Clearing (excluding any collateral arrangement in favour of NG Clearing on behalf of or on trust for clients of the applicant). The Security Document(s) will include a perfected, first-ranking, fixed security interest over all Asset Cover (other than cash) provided by the applicant to NG Clearing (or as may be applicable, its agents, Custodians or Securities System Operator) pursuant to the Rules.

- NG Clearing may request a copy of the banking license (commercial or merchant) issued by the Central Bank of Nigeria (the “CBN”) and certified by the applicant’s Company Secretary. The applicant shall at all times be appropriately authorized by the CBN and additionally meet any notification or authorization requirements set by any relevant regulator.

- Undertaking to:

- comply with NG Clearing’s Rulebook, Procedures, Guidelines and Circulars, all applicable laws and regulations

- immediately provide NG Clearing with up-to-date notification of any organizational changes or any changes that occur on any of the information or document previously submitted to NG Clearing, including at the time of application for membership; and.

- satisfy any further requirements which NG Clearing may reasonably impose on the applicant from time to time.

- The applicant must be a body corporate, or entity duly incorporated in Nigeria. The applicant shall submit the following:

- a copy of the Certificate of Incorporation duly certified by the Company Secretary;

- Copies of its Forms CAC 2A (shareholding), 2.1 (registered office address), 3 (Company Secretary) and 7A (Directors) certified by the Corporate Affairs Commission not later than 30 days from the date of submission.

- Evidence of SEC registration as a derivatives clearing member; and

- Latest tax clearance certificate.

- A copy of the current Memorandum and Articles of Association certified by the Company Secretary, which include an object clause that allows the entity to perform the functions of a derivatives clearing member.

- Evidence of the minimum paid up capital stipulated by the Central Bank of Nigeria and/or NG Clearing.

- A copy of the company’s audited financial statements for the last 3 (three years) and the most recent Form CAC 10A (annual returns), where applicable.

- The applicant’s organogram, profile, history, shareholding structure and principal officers.

- Where required by NG Clearing, consent letter to conduct Know Your Customer (“KYC”) checks with the applicant’s regulator, in the event that NG Clearing wishes to conduct some checks.

- Certificate of incumbency containing a specimen of the signature of the signatories to the Membership Agreement, undertaking(s) and any other agreement between NG Clearing and the applicant. The certificate of incumbency shall also contain a specimen of the Company Secretary’s signature.

.

All Clearing Members (General Clearing Members (“GCM”), Self-Clearing Members (“SCM”), Professional Clearing Members (“PCM”)) are required to pay a one-off, non-risk-based application fee as stated in the table below. The application fee is a one-time fee charged after the prospective member's application has been approved in accordance with Rule 3 of the Rules and any applicable Circular.

| Fee | GCM/PCM (N) | SCM (N) |

| Application Fee | 1,500,000.00 | 1,000,000.00 |

| Additional (N)200,000 for every trading member onboarded by the Clearing Member. | ||

All Clearing Members are required to pay an annual membership fee. The fee is charged on a pro-rata basis (calculated from the admission date to the end of the financial year) and payable before the admission date. For the following years, the membership fees will be charged at the beginning of the financial year.

The annual membership fee is charged in respect of each segment as follows:

Segment | GCM/PM (N) | SCM (N) |

Equity Derivative Segment | 10,000,000.00 | 7,500,000.00 |

NG Clearing shall charge Clearing fees for the clearing and settlement of all contracts received from an Approved Trading Venue. Clearing fees are invoiced to the Clearing Members every month. The invoice is delivered as part of the End-Of-Month (EOM) report to the Clearing Members. The debits are effected 5 Business Days after the invoice is communicated. The clearing fee is charged in respect of each segment as follows:

Contract | Clearing Fee Rate of Notional Amount |

Index Future | 0.040% |

Single Stock Future | 0.040% |

NG Clearing shall charge 0.02% of nominal amount of open position per month to the Clearing Member. The invoice is also delivered as part of the EOM report to the Clearing Member, and debits are effected 5 Business Days after the invoice is issued.

Interested institutions are invited to complete the Clearing Member application form and submit to the Company for due diligence and onboarding processing.